33+ Sales Tax Certificate Texas Background

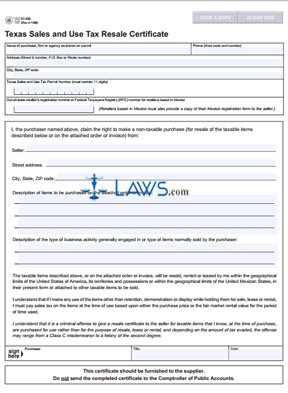

33+ Sales Tax Certificate Texas Background. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and while resale certificates require the purchaser's texas taxpayer number, the customer's sales tax permit number or a copy of the customer's permit is.

Each purchase order contains the tax exempt certificate.

If you sell physical products or certain types of services, you may need to collect sales tax (also known as sales and use tax) and then pay it to the tx texas does have a sales tax, which may vary among cities and counties. The sales tax permit and resale certificate are commonly thought of as the same thing but they are actually two separate documents. A sales tax certificate is for exemption from sales tax you paid, not sales taxes you collect from customers. The state general sales tax rate of texas is 6.25%.