34+ Tax Exemption Certificate Illinois Pictures

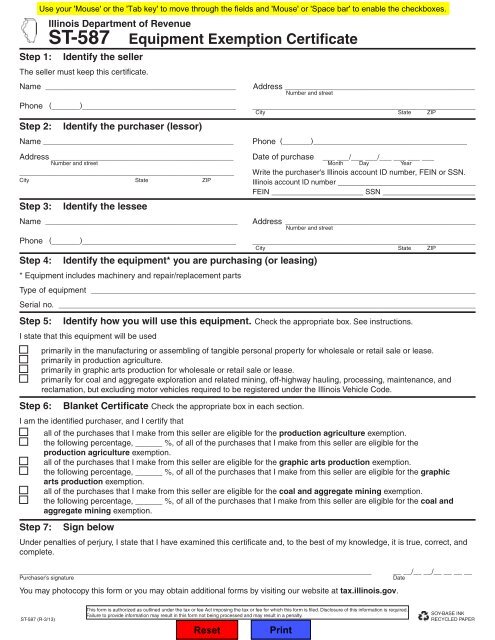

34+ Tax Exemption Certificate Illinois Pictures. This includes most tangible personal property and. Exemption certificates are a way for a business or organization to attest that you are a tax exempt entity, or that you are purchasing an item with the intent to use it in a way that has been deemed exempt from tax.

Certificate of eligibility for sales and use tax exemption — community water supply.

But if that day falls on a weekend or holiday, the personal exemption of $2,275 per filer (and spouse, if filing jointly), which is subject to base income limits by filing status. Sellers should exclude from taxable sales the seller accepts an exemption certificate from a purchaser claiming to be an entity that is not subject to sales and use taxes, if both of the following. Misplacing a sales tax exemption/resale certificate. Exemption certificates are a way for a business or organization to attest that you are a tax exempt entity, or that you are purchasing an item with the intent to use it in a way that has been deemed exempt from tax.